48+ can i deduct mortgage interest on a second home

Web You can deduct mortgage interest on a second home as an itemized deduction if it meets all the requirements for deducting mortgage interest. 13 1987 and used for other purposes besides buying building or improving your homes.

Second Home Tax Benefits You Should Know Pacaso

Web You cant deduct home mortgage interest unless the following conditions are met.

. Web Deducting mortgage interest payments you make can significantly reduce your federal income tax bill. Web The home mortgage interest deduction is a rule that allows homeowners to deduct the interest paid on a home loan in a given tax year lowering their total taxable. Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage.

Web For any home loan taken out on or before October 13 1987 all mortgage interest is fully deductible For home loan taken out after October 13 1987 and before. Web These are mortgages taken out after Oct. According to the rules if you have more than two properties you can only claim two of them as your primary and.

The tax rules do allow you to take the deduction on up to two homes but. Web You can apply mortgage interest and deductions for that home. Homeowners who bought houses before December 16.

Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. Web Yes you can include the mortgage interest and property taxes from both of your homes. Web If your relative lives in the home for less than 14 days or 10 percent of total rental days you do not meet the personal use test but you still can deduct mortgage interest on.

Web For example if the mortgage balance on your primary home is 450000 and your secondary home is 300000 then you can combine the two and deduct all the. Generally for the first and. Web Beyond everyday costs more than half 58 of Canadians are worried about interest rate increases affecting their ability to pay off debt such as credit cards loans.

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. However the deduction for mortgage interest starts to be limited at either. You file Form 1040 or 1040-SR and itemize deductions on Schedule A Form 1040.

Mortgage interest paid on a second residence used personally is deductible as long as the mortgage satisfies the same requirements for deductible.

Oahu Real Estate Market Update 2019 Mid Year Oahu Real Estate Blog Outstanding Info

Can You Deduct Mortgage Interest On A Second Home Moneytips

Why The Mortgage Interest Tax Deduction Has Got To Go Streetsblog Usa

Can You Deduct Mortgage Interest On A Second Home Moneytips

Can I Still Deduct My Mortgage Interest

3 Things You Need To Know About Second Home Tax Deductions

Mortgage Interest Tax Deduction Smartasset Com

Business Succession Planning And Exit Strategies For The Closely Held

Can I Deduct The Mortgage Interest On A Home I Own In Which A Family Member Lives

Buying A Second Home Tax Tips For Homeowners Turbotax Tax Tips Videos

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Mortgage Interest Deduction How It Calculate Tax Savings

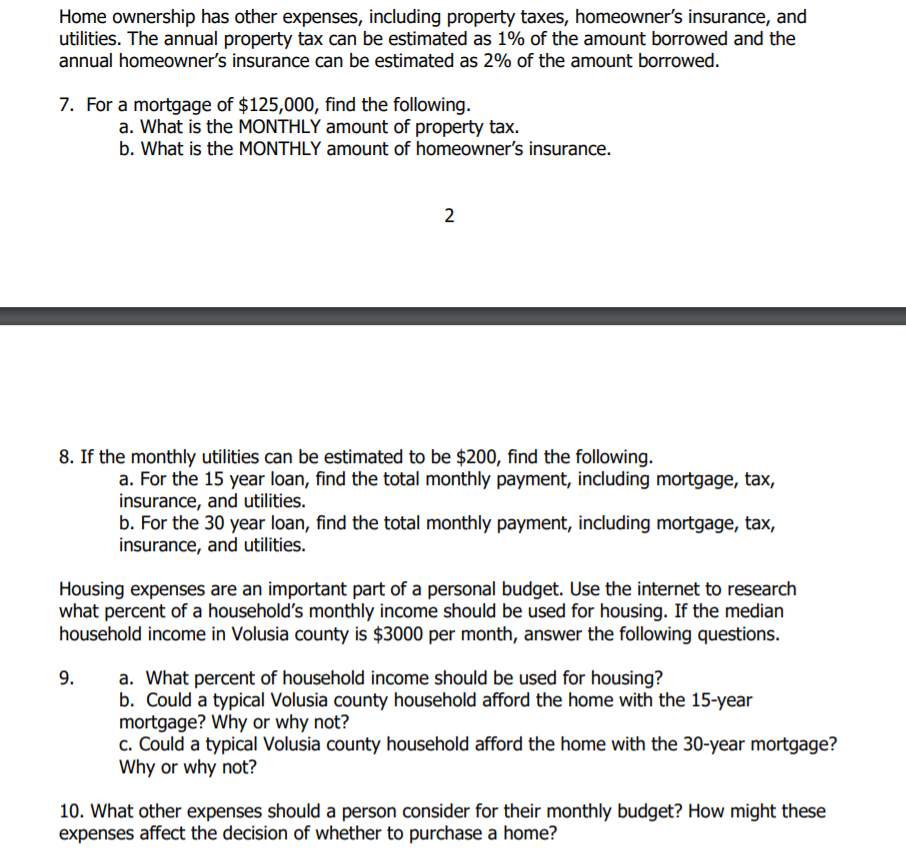

Solved Home Ownership Has Other Expenses Including Property Chegg Com

Can You Deduct Mortgage Interest On A Second Home Moneytips

![]()

195429 Apple Touch Icon Png

Can You Deduct Mortgage Interest On A Second Home Moneytips

Second Home Tax Deductions Benefits What Can You Deduct Orchard